When it comes to navigating the dynamic world of cryptocurrencies, choosing the right exchange is crucial. For traders and investors alike, binance vs okx stands out as two of the most prominent platforms in the market today. Both exchanges boast extensive features, vast cryptocurrency selections, and robust security measures, but they also differ significantly in terms of user experience, fee structures, and global reach. This comprehensive comparison aims to dissect each platform thoroughly, helping crypto enthusiasts make informed decisions aligned with their trading needs.

Binance vs OKX: A Comprehensive Comparison

In this section, we will explore the foundational differences between Binance and OKX, setting the stage for deeper analysis. Although both are giants in the crypto exchange industry, their origins, target audiences, and overall philosophies differ. Binance, founded in 2017, rapidly grew into a dominant force with a focus on innovation, low fees, and a vast array of cryptocurrencies. Conversely, OKX, established in 2017 under Okex Technology Company, emphasizes advanced trading tools, derivatives, and catering to more experienced traders.

Understanding these broad strokes helps contextualize their respective strengths and weaknesses. While Binance’s approach champions accessibility and variety, OKX leans toward sophisticated trading features and comprehensive risk management. This foundational comparison is essential for grasping how each platform caters to specific user demographics and trading styles.

Origins and Background of Binance and OKX

Binance emerged from China before relocating its headquarters to Malta and later establishing a decentralized global presence. Its rapid growth can be attributed to aggressive marketing, innovative features, and a focus on building an ecosystem that includes staking, savings, and launchpad initiatives. Binance has also diversified into other financial services, such as futures trading, NFT marketplaces, and decentralized finance (DeFi).

OKX started as OKCoin, a digital asset exchange based in China, but rebranded itself as OKX to differentiate from its sister platform. It positioned itself as a comprehensive platform for trading derivatives, spot markets, and institutional investments. With a focus on security, transparency, and advanced trading mechanics, OKX became popular among seasoned traders seeking sophisticated tools.

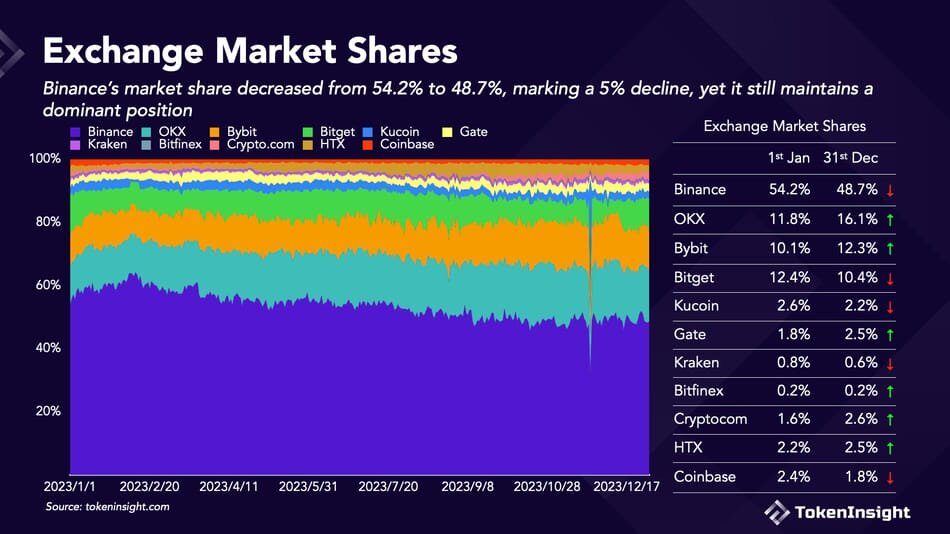

Market Position and Global Reach

Binance’s global footprint is unmatched, operating in over 180 countries with localized interfaces, multiple fiat gateways, and strategic partnerships worldwide. Its influence is evident through numerous initiatives aimed at mainstream adoption, including educational programs, charitable activities, and collaborations with traditional finance institutions.

OKX, while also international, maintains a slightly more focused geographic presence, especially strong in Asia and parts of Europe. Its user base comprises mainly professional traders and institutional clients who require complex derivative products and high liquidity. The platform’s regulatory environment varies across regions—while Binance faces scrutiny in some jurisdictions, OKX tends to prioritize compliance with local laws, which influences its operational scope.

User Demographics and Target Audience

Binance appeals broadly to new entrants, retail traders, and even institutional investors due to its user-friendly interface, extensive educational resources, and low fees. Its product diversity ensures that users at various experience levels find value, whether they’re buying Bitcoin or exploring DeFi projects.

OKX, by contrast, attracts more experienced traders and institutional clients. Its advanced charting tools, margin trading options, and derivatives offerings cater to high-volume traders looking for sophisticated risk management and leverage options. While both platforms serve retail clients, OKX’s emphasis on complex trading strategies sets it apart as a platform for professional-grade investing.

Trading Features: Binance vs OKX

The core of any crypto exchange lies in its trading capabilities. Both Binance and OKX offer robust trading environments, but their approaches to features, tools, and customization vary significantly. Traders should evaluate these aspects based on their experience level, trading style, and specific needs.

In the subsequent sections, we’ll analyze order types, trading interfaces, leverage options, and unique functionalities provided by each platform to understand how they serve different trader profiles.

Trading Platforms and Interfaces

Binance provides a streamlined, intuitive interface suitable for beginners while also offering a professional mode for advanced traders. Its web platform features customizable dashboards, real-time data feeds, and quick access to trading pairs. The mobile app mirrors desktop functionalities, allowing seamless trading on the go.

OKX’s trading interface emphasizes complexity and depth, appealing to professional traders. Its advanced trading terminal offers detailed charting tools, multiple order types, and real-time analytics. The platform supports both web and desktop applications, with customizable layouts tailored for technical analysis and high-frequency trading.

Order Types and Trading Options

Binance supports a wide array of order types, including limit, market, stop-limit, OCO (One Cancels the Other), and post-only orders, giving traders flexibility in execution strategies. The platform also offers futures, margin trading, and options trading, expanding opportunities beyond spot trading.

OKX excels in derivatives and margin trading, providing leveraged trading up to 125x on select pairs. Its order types include the standard limit and market, along with advanced options like conditional orders and advanced stop orders. This enables traders to implement complex trading strategies effectively.

Leverage and Margin Trading

Leverage is a critical feature for traders aiming to amplify gains—but it also increases risk. Binance offers leverage up to 125x on futures trading, but users are advised to exercise caution given the volatility involved. The platform employs risk management systems, including liquidation mechanisms, to protect traders and itself.

OKX’s margin trading allows leverage up to 125x as well, supported by comprehensive risk control features such as cross-margin and isolated-margin modes. Its advanced trading tools enable traders to use multiple positions simultaneously, hedge risks, and execute sophisticated strategies.

Unique Functionalities and Innovations

Binance continually innovates with features like staking, Launchpad token sales, savings accounts, and integration with DeFi protocols. Its Smart Chain ecosystem facilitates decentralized applications directly within the Binance platform, fostering a multi-faceted trading environment.

OKX focuses on derivatives, offering futures, perpetual swaps, and options with deep liquidity and high-speed execution. Its Risk Engine and Auto-Deleveraging (ADL) system mitigate losses during volatile markets. Additionally, OKX provides a crypto lending platform and institutional-grade OTC desk, catering to different trading needs.

Fees and Charges: Binance vs OKX

Fee structures significantly impact profitability, especially for high-frequency traders and those executing large volumes. Both Binance and OKX promote competitive rates, but their fee models involve different nuances and additional costs. In this section, we’ll dissect trading fees, withdrawal charges, and other applicable expenses.

Understanding these elements can help traders optimize their cost-efficiency and choose a platform that aligns with their trading volume and strategy.

Trading Fees and Structure

Binance operates on a tiered fee structure based on 30-day trading volume and BNB (Binance Coin) holdings. Its standard trading fee starts at 0.1% for spot trading, with discounts available for higher volume traders or those paying with BNB, reducing fees to as low as 0.02%.

OKX employs a similar tiered fee system, with spot trading fees starting at 0.1%. However, the platform often offers promotional discounts and fee reductions for VIP members or high-volume traders. Its fee structure is transparent, and discounts are directly applied depending on trading activity.

Withdrawal and Deposit Fees

Both platforms charge withdrawal fees, which fluctuate based on the blockchain network congestion and transaction size. Binance typically maintains fixed withdrawal fees per cryptocurrency, e.g., 0.0005 BTC for Bitcoin withdrawals, while OKX’s fees are generally comparable, sometimes slightly lower or higher depending on the coin.

Deposit fees are usually zero on both exchanges for most cryptocurrencies, encouraging deposits. However, fiat deposit methods may incur fees depending on the payment gateway used.

Additional Charges and Hidden Costs

While trading and withdrawal fees are the main costs, users should consider other potential charges, such as:

- Margin funding fees

- Premium features or advanced tools

- Currency conversion fees when using fiat gateways

Both platforms are transparent about their fee structures, but traders should review prior to executing high-volume trades to avoid surprises.

Fee Comparisons in Different Scenarios

For small traders, the difference in fees might be negligible, but for large-volume traders, discounts and fee tiers can significantly impact profitability. Both Binance and OKX reward high turnover with reduced fees, but Binance’s broader ecosystem and frequent promotions give it an edge for cost-conscious traders.

Security Measures: Binance vs OKX

Security is paramount in the crypto space, where hacking incidents and thefts pose persistent threats. Both Binance and OKX recognize this reality and employ multiple layers of security measures. Nonetheless, their approaches to safeguarding assets and user information differ.

This comparison explores authentication protocols, fund protection mechanisms, incident response strategies, and compliance with global security standards.

Authentication and Access Control

Binance uses two-factor authentication (2FA), biometric logins, and email verification to secure accounts. The platform encourages users to enable all security features, including anti-phishing codes, withdrawal whitelist, and device management.

OKX also prioritizes security through 2FA, SMS verification, and email alerts. It offers advanced login protection, including hardware security keys for institutional users, and promotes best practices like strong passwords and regular account reviews.

Cold Storage and Fund Security

To protect user funds, Binance stores the majority of assets in offline cold wallets, reducing exposure to online threats. They also utilize multi-signature wallets and routine security audits. Binance claims that around 90% of user funds are stored offline, enhancing security during cyberattacks.

OKX follows a similar approach, keeping most assets in cold storage, deploying multi-signature protocols, and conducting regular security assessments. Their compliance with international standards, such as ISO/IEC certifications, adds credibility.

Incident Response and Insurance Funds

Both exchanges maintain insurance funds or reserves to cover potential losses resulting from security breaches. Binance has a Secure Asset Fund for Users (SAFU) set aside for emergencies, which was activated after past incidents.

OKX employs an insurance fund to reimburse affected users in case of breaches. Transparent incident reporting and swift response teams are vital components of their security posture, ensuring trust remains intact.

Regulatory Compliance and Security Standards

Adherence to evolving regulations and security standards signals a platform’s commitment to safety. Binance has faced regulatory scrutiny in multiple jurisdictions but continues to improve compliance procedures, including KYC (Know Your Customer) processes.

OKX emphasizes compliance with regional laws and follows global security practices, including regular audits, AML procedures, and adherence to GDPR where applicable.

User Experience: Binance vs OKX

A seamless, intuitive user experience greatly enhances trading efficiency and satisfaction. Both Binance and OKX invest heavily in UI/UX design, but their philosophies reflect their target audiences—Binance balancing simplicity with advanced features, and OKX focusing on power-user tools.

Before delving into specifics, it’s important to acknowledge that user preferences often depend on familiarity with trading platforms, desired features, and navigation ease.

Platform Design and Navigation

Binance features a clean, modern interface that caters to both newcomers and seasoned traders. The homepage provides quick access to markets, news, and account management. The interface can be toggled between basic and advanced modes, making it adaptable as users grow more confident.

OKX’s platform design leans toward technical sophistication, with dense charts, multiple order-book views, and complex menus. While it may seem overwhelming initially, experienced traders appreciate its depth and customization options, which streamline high-volume operations.

Ease of Onboarding and Registration

Both platforms streamline onboarding through straightforward registration processes involving email or phone verification. Binance offers a smooth KYC process, with guides to assist new users through identity verification, which is often mandatory for withdrawing fiat or higher trading limits.

OKX similarly simplifies registration but emphasizes thorough KYC compliance early in the process to facilitate compliance with regional regulations. Its onboarding may include additional security checks for institutional clients.

Availability of Educational Resources

Binance has a comprehensive “Academy” offering tutorials, webinars, and articles that cater to novice traders. Its user guides break down complex topics into digestible content, empowering beginners to navigate the platform confidently.

OKX provides detailed documentation, video tutorials, and trading guides geared toward advanced users. Its resource center emphasizes technical analysis, derivatives trading, and risk management, aligning with its target audience.

Mobile App Performance and Functionality

Both exchanges offer robust mobile apps compatible with Android and iOS devices. Binance’s app is praised for stability, speed, and feature parity with the desktop version, allowing users to trade, stake, and manage accounts seamlessly.

OKX’s app also delivers a full suite of features, including advanced charting tools and derivatives trading. While some users report occasional lags during high volatility, overall, both platforms offer reliable mobile experiences.

Available Cryptocurrencies: Binance vs OKX

The variety of cryptocurrencies available for trading is a major attraction for users. A wider selection enables diversification and access to emerging tokens, increasing trading opportunities. Both Binance and OKX support hundreds of cryptocurrencies, but their lists have notable differences in scope and depth.

In this section, we examine their coin offerings, listing policies, and support for new tokens.

Cryptocurrency Listings and Diversity

Binance boasts one of the largest digital asset libraries globally, supporting thousands of tokens across spot, futures, and DeFi markets. Its listing process involves community voting and rigorous evaluation, enabling a steady influx of new projects.

OKX also offers a diverse portfolio of coins, with a focus on established tokens and trending altcoins. Its listings are curated carefully, prioritizing security and project legitimacy, which maintains platform integrity.

Support for Emerging and Popular Coins

Binance frequently lists hotly anticipated tokens shortly after their launch, often through its Launchpad platform. This proactive approach gives traders early access to new projects with significant growth potential.

OKX tends to list more mature coins and does not emphasize initial coin offerings as heavily but ensures liquidity and stability for listed assets. It balances innovation with risk mitigation by selective listing.

Range of Tokens in Different Market Segments

Both exchanges support various market segments, including:

- Major cryptocurrencies (Bitcoin, Ethereum, etc.)

- Altcoins with high market caps

- DeFi tokens and governance coins

- Stablecoins and fiat-pegged assets

- Tokenized assets and NFTs (more prevalent on Binance)

Their support for diverse tokens allows traders to diversify portfolios across sectors like DeFi, gaming, and enterprise solutions.

Cross-Platform Compatibility and Token Management

Binance and OKX facilitate easy deposit, withdrawal, and transfer of tokens across wallets and platforms. They support standard tokens adhering to ERC-20, BEP-2, and other standards, ensuring broad compatibility.

Moreover, both platforms offer wallet management tools, enabling users to view balances, track transactions, and manage multiple addresses efficiently.

Customer Support: Binance vs OKX

Reliable customer service is vital, especially during volatile market conditions or technical issues. Both Binance and OKX provide multiple support channels, but their responsiveness and quality vary.

In this segment, we analyze communication methods, problem resolution efficiency, and resource availability to gauge user satisfaction.

Support Channels and Accessibility

Binance offers support via live chat, email, ticket submissions, and a comprehensive FAQ portal. Its live chat feature provides immediate assistance, though wait times can fluctuate during peak periods.

OKX also provides 24/7 customer support through live chat, email, and ticketing systems. Its dedicated support team emphasizes prompt responses, especially for institutional clients and VIP users.

Response Time and Issue Resolution

During typical trading hours, Binance’s support team responds within minutes to hours depending on the query’s complexity. Common issues like login problems, transaction inquiries, or API integrations are addressed efficiently.

OKX’s support team aims for rapid resolution, with many users reporting satisfactory turnaround times. However, during extreme market surges, delays can occur on both platforms due to high traffic.

Quality of Support and User Satisfaction

Customer feedback highlights Binance’s extensive self-help resources and helpful support staff. Some users note that language barriers or automated responses occasionally hinder quick issue resolution.

OKX’s support team receives positive comments for professionalism and detailed guidance, especially for advanced trading concerns. Nonetheless, some users suggest improving multilingual support and streamlining escalation procedures.

Community Engagement and Educational Outreach

Both platforms actively engage with their communities through social media, webinars, and educational campaigns. Binance’s Telegram groups, Twitter updates, and YouTube channels foster community interaction.

OKX organizes webinars, AMAs, and detailed tutorials, fostering a close-knit relationship with its user base, particularly in regions emphasizing professional trading.

Liquidity and Volume: Binance vs OKX

Liquidity and trading volume are critical indicators of a platform’s health, reliability, and ability to execute large orders without slippage. High liquidity ensures tighter spreads and more accurate pricing, thereby attracting serious traders.

Here, we assess their liquidity metrics, trading volumes, and market depth to see how they compare.

Trading Volume Metrics

Binance consistently ranks as the world’s largest crypto exchange by total daily trading volume, often surpassing competitors by several billion dollars. Its high volume translates into deep order books and fast execution speeds.

OKX also maintains substantial trading volumes, particularly in derivatives markets, making it one of the top platforms globally. While its spot trading volume is impressive, it often trails behind Binance but compensates with its rich derivatives offerings.

Market Depth and Order Book Liquidity

Market depth refers to the volume of buy and sell orders at various price levels. Binance’s order books are highly liquid across most major trading pairs, minimizing price impact and slippage.

OKX exhibits strong liquidity in key derivatives and fiat-to-crypto pairs, though certain less popular tokens may experience wider spreads. For high-volume traders, Binance offers marginally better depth, but OKX remains competitive in its niches.

Impact on Trading Strategies

High liquidity benefits day traders, arbitrageurs, and institutional entities by allowing sizable trades without significant price deviations. It reduces risks associated with market manipulation or sudden volatility.

Both platforms, therefore, cater to institutional-grade traders, but Binance’s sheer scale makes it the preferred choice for executing large orders swiftly and reliably.

Regional Liquidity Variations

Regional factors influence liquidity; Binance’s global presence ensures consistent liquidity across regions. OKX’s liquidity is robust in Asia and Europe but may vary in less-covered markets.

Understanding these nuances allows traders to select the most appropriate platform based on their geographical location and trading preferences.

Regulatory Compliance: Binance vs OKX

Navigating regulatory landscapes is increasingly vital for crypto exchanges. Regulations affect platform operations, user eligibility, and legal standing. Both Binance and OKX face regulatory scrutiny and aim to enhance compliance, albeit with differing strategies.

This section analyzes their compliance frameworks, licensing, and adaptability to changing laws.

Licensing and Legal Standing

Binance has historically operated in a somewhat decentralized manner, avoiding heavy reliance on specific jurisdictions. Recently, it has sought licenses in regions like Singapore, France, and Bahrain to bolster credibility.

OKX emphasizes regulatory compliance by establishing local entities, securing licenses, and adhering to AML/KYC protocols. It maintains transparency regarding its legal status, especially in regulated markets like Japan and Europe.

KYC and AML Procedures

Both exchanges enforce strict KYC procedures for higher withdrawal limits, fiat transactions, and institutional accounts. Binance’s KYC process involves government ID verification, facial recognition, and address validation.

OKX employs similar measures, emphasizing compliance with regional AML standards. Its onboarding process may include enhanced verification for institutional clients, aligning with legal requirements.

Adaptability to Regulatory Changes

Binance’s approach involves proactive engagement with regulators, adjusting services in response to legal developments. It has exited certain jurisdictions or limited services to comply with local laws.

OKX’s strategy emphasizes compliance and cooperation with authorities, often obtaining necessary licenses before expanding services. This regulatory adaptability enhances long-term stability and user trust.

Future Outlook on Regulation

Both platforms recognize that future regulation will shape the industry. They are investing in compliance infrastructure, legal teams, and transparency efforts to prepare for increased oversight, which may include stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) standards.

Final Verdict: Binance vs OKX

In evaluating binance vs okx, both platforms demonstrate strengths tailored to distinct user needs. Binance leads with unmatched liquidity, a vast array of cryptocurrencies, and user-friendly features that appeal to both beginners and high-volume traders. Its innovative ecosystem and global reach make it a versatile choice for mainstream adoption.

OKX distinguishes itself through its advanced trading tools, superior derivatives offerings, and a focus on professional traders. Its commitment to security and regulatory compliance further bolsters its reputation among institutional clients and seasoned traders.

Choosing between them depends primarily on your trading style, experience level, and specific goals. If you seek broad accessibility, extensive coin options, and low fees, Binance is likely the optimal choice. Conversely, if your focus is on sophisticated trading, leverage, and derivatives, OKX provides a powerful platform tailored to such needs.

Both platforms continue evolving in response to technological advances and regulatory shifts, promising ongoing improvements and new opportunities for users. Ultimately, binance vs okx presents two formidable options poised to shape the future of crypto trading.

The comparison between Binance and OKX reveals two leaders in the cryptocurrency exchange industry, each excelling in different areas. Binance’s expansive ecosystem, liquidity, and ease of use make it ideal for a broad user base, while OKX’s advanced features and focus on professional traders make it a compelling choice for experienced investors. Both prioritize security and compliance, adapting to regulatory environments with strategic agility. Your decision should align with your trading goals, technical expertise, and risk appetite, but rest assured that either platform provides a solid foundation for engaging in the exciting world of cryptocurrencies.